If you are a Canadian with young children, you may have recently received mail from Canada Revenue Agency (CRA) regarding the Canada Child Benefit (CCB) and the BC Early Childhood Tax Benefit (BCECTB). Wow- that’s a mouthful! Let’s break it down….

The Canada Child Benefit (CCB)

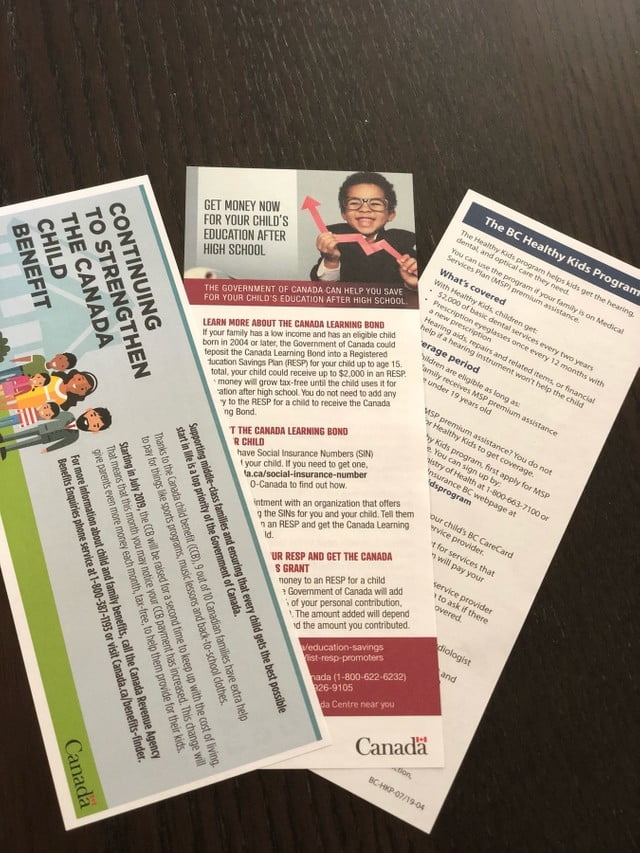

A tax-free payment to families with children aged 0-17.This most recent notice included a separate information brochure that stated: “Starting in July 2019, the CCB will be raised for a second time to keep up with the cost of living. That means that this month you may notice your CCB payment has increased.” As of July 2019, The maximum annual benefit has increased to $6,639 per child under age 6 and to $5,602 per child age 6 through 17.

Some of our clients have noticed a difference in their entitlement from year to year, so make sure to read your notice carefully. It may be due to a change in income or marital status, age of your child (ex. Over the age of 6), number of children in your care or a recent move. It is rare, but in some cases, it could be an error. If you need clarification, log in to your CRA “My Account” to access your personal information or feel free to contact our office to look into it for you.

There is also a helpful online calculator through CRA, available here. It will help calculate what you should be receiving each month based on a number of questions.

BC Early Childhood Tax Benefit (BCECTB)

If you have a child under the age of 6, and you are eligible, you will receive an additional monthly tax-free payment from the Canadian government. This payment is calculated based on your income, marital status, and province/territory of residence. They will specifically look at your family net income from the previous year (in this case, 2018).

Two other areas CRA provided information on:

BC Healthy Kids Program

If you are already on MSP, you can use this program to receive additional coverage related to your child’s basic dental services, prescription eyeglasses, hearing aids, etc. For all children under 19 years old who are already covered under MSP. For more information, visit www.gov.bc.ca

Canada Learning Bond

If your family has a low income and an eligible child born in 2004 or later, the Canadian government could deposti the Canada Learning Bond into an RESP for your child up to the age of 15. In total, your child could recieve up to $2000 in a tax-free RESP to use towards post-secondary education. You can also add money to an RESP for your child up to the age of 17, and the Candian government will add between 20-40% of your contribution (to a max of $7,200).

As always, feel free to ask us if you have any questions regarding your child’s education savings, RESP contributions, or any of these government benefits/savings/etc.