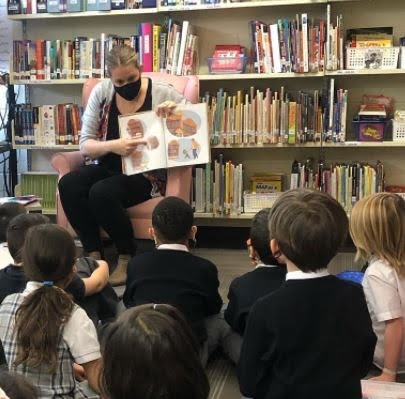

Education and teachers are really important to us here at Cahill CPA- our partner’s wife Crystal Cahill is a teacher herself! We know firsthand how educators spend so much of their own money on their classrooms & for their students, so we wanted to remind you about the refundable tax credit available to teachers. Although it isn’t much, it could make a small difference to your return this year.

Some important changes or points to note:

- This was previously 15% of your expenses, and is now 25%. Up to a maximum of $1000.

- Even if you taught online/from home, you are able to claim teaching expenses if they facilitated student learning.

- Teaching devices such as video streaming devices, projectors, speakers, etc. that you needed to facilitate at-home learning for your students can be eligible.

- If you purchased masks for your students at your own cost, they can be considered a consumable, eligible expense.

***Please be sure to keep all receipts, and know that you may be asked for confirmation from your employer that you were not reimbursed for the expenses claimed.

As always, let your accountant know at tax time if you are a teacher or educator, and if you have expenses you would like to claim under this support.

Enhanced Support for Teachers

Under current rules, teachers and early childhood educators may claim a 15-per-cent refundable tax credit based on an amount of up to $1,000 in expenditures made in a taxation year for eligible supplies.

Eligible supplies must be purchased for use in a school or in a regulated child care facility for the purpose of teaching or facilitating students’ learning. Eligible supplies include the following durable goods: books; games and puzzles; containers (such as plastic boxes or banker boxes); and educational support software. Eligible supplies also include consumable goods, such as construction paper for activities, flashcards or activity centres.

If you were an eligible educator, you can claim up to $1,000 of eligible supplies expenses.

Eligible educator

You are considered an eligible educator if, at any time during the 2021 tax year, both of the following conditions are met:

- You were employed in Canada as a teacher or an early childhood educator at an elementary or secondary school, or a regulated child care facility

- You held a teaching certificate, license, permit or diploma, or a certificate or diploma in early childhood education, which was valid and recognized in the province or territory in which you were employed

Eligible supplies expenses

An eligible supplies expense is the amount that you paid in 2021 for teaching supplies that meet all of the following conditions:

- You bought the teaching supplies for teaching or facilitating students’ learning

- The teaching supplies were directly consumed or used in the performance of the duties of the eligible educator’s employment

- The teaching supplies were directly consumed or used in the performance of the duties of the eligible educator’s employment

- You were not entitled to a reimbursement, allowance, or any other form of assistance for the expense (unless the amount is included in the calculation of your income from any tax year and is not deductible in the calculation of your taxable income)

- The eligible teaching supplies expense was not deducted from any person’s income for any year or included in calculating a deduction from any person’s tax payable for any year

Teaching supplies are consumable supplies and prescribed durable goods. Durable goods are:

- books, games, and puzzles

- containers (such as plastic boxes or banker boxes)

- educational support software

- calculators (including graphing calculators)

- external data storage devices

- web cams, microphones and headphones

- wireless pointer devices

- electronic educational toys

- digital timers

- speakers

- video streaming devices

- multimedia projectors

- printers

- laptop, desktop and tablet computers, provided that none of these items are made available to the eligible educator by their employer for use outside of the classroom

Notes

Teaching supplies purchased in order to teach from an online platform due to COVID-19 are eligible for this credit if all of the conditions above have been met.

Disposable masks that are not supplied by your school are considered consumable supplies if students are required to wear them in your classroom and all of the conditions above have been met.

The CRA may ask you later to provide a written certificate from your employer or a delegated official of the employer (such as the principal of the school or the manager of the child care facility) attesting to the eligibility of your expenses for the year.